Individuals who both pay and file their self-assessment income tax returns through the Revenue Online System (ROS) have until Wednesday 15th November 2023 to pay a one-off pension contribution and claim the income tax relief against the 2022 tax year.

As a self-assessed individual, the good news about making a pension contribution is that you can reduce your tax liability for the previous year, and in doing so you may also reduce the preliminary tax for the current year. This can mean there is a dual benefit to you!

This is best shown in the example below.

MEET JANE – A 31 YEAR SELF EMPLOYED ARCHITECT

- Jane pays income tax at the marginal rate (40%)

- She made pension contribution of €10,000 before the 15th November 2023.

- On her 2022 tax return, Jane can claim tax relief of €4,000 on this contribution.

- So, the actual cost to Jane is €6,000

How much can I pay into my pension?

The amount which you can make depends on your net relevant earnings and your age. The maximum earning limit for tax relief on pension contributions for 2023 is €115,000.

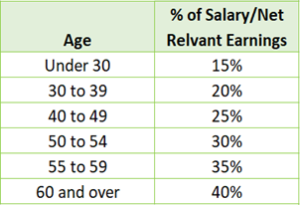

Based on your age, the table below, shows how much of your relevant earnings you can contribute.

Relevant Earnings include income from a trade or profession, PAYE Income, Directorship Income

How can we help you?

FLC Frank Lynch & Co and Avoca Financial Services can assist in helping you choose the correct pension plan – whether this a one-off lump sum or making regular contributions.

If you are thinking about setting up a regular pension plan or want us to review your existing plan, please contact us on 0429328004 or email advisor@avocafs.ie

As this release is intended as a general guide to the subject matter, it should not be used as a basis for decisions. For this purpose advice should be obtained which takes into account all the clients circumstances. Every effort has been made to ensure the accuracy of the information in this release. In view of its purpose, the reader will appreciate that we are unable to accept liability or any errors or omissions which may arise.